Ready to Pay More in Taxes?

Austin Carroll is a financial advisor at Cornerstone based in Reno, NV. Austin has passed his Series 65 Securities Registration Examination. He helps clients create customized financial plans based on their unique financial goals by addressing topics such as income, investments, and taxes.

READY TO PAY MORE IN TAXES?

I’m sure that most people will be saying ‘no’ to paying more in taxes, but you may not have a choice come year 2026. Currently, the tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire by the end of 2025 and for most people, that means that taxes will be going up. One of the main rebuttals I get to this is that if the Republicans take back the majority in Congress and the Senate, they could extend those tax credits again? But what if I told you that they may not be able to afford an extension to the tax cuts?

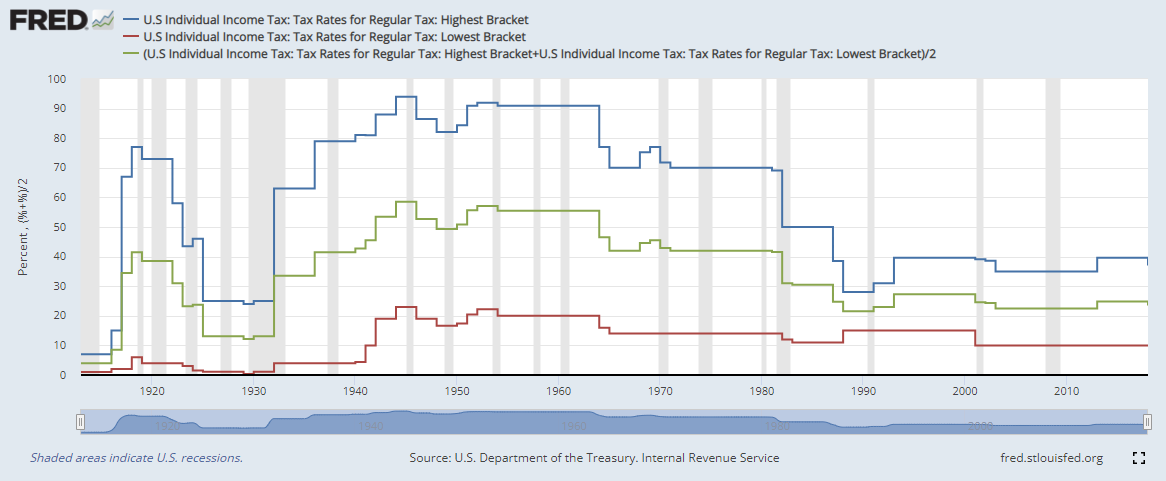

In the United States, we have a system of progressive tax brackets, meaning that once you have filled up on bracket of earnings, the next bracket begins to fill. You only get taxed on the money that is in each respective bracket. The issue for retirees is that these brackets are at a historical low. You read that correctly, taxes are LOW right now! For example, in 1916 the highest tax bracket was 15%, but by 1917, one year later, the highest tax bracket was 67%. Granted, these high tax brackets were because the United States was strapped for cash and funding WWI but funding the New Deal and WWII didn’t help taxpayers either. In 1931 the highest bracket was 25%, but by 1932, the highest bracket had jumped all the way back up to 63%, where it stayed above that level until 1982! During that 50-year run the highest tax bracket even hit 94% during 1945 to help fund WWII. Today the highest bracket is 37% and we have just injected over $5 trillion dollars into the economy.

If you are a retiree or about to retire, this could have massive implications for you and your ability to retire and stay retired. Your financial advisor should be talking with you about doing the things necessary to create the most tax efficient situation for yourself. At Cornerstone, we perform a Retirement Road Map designed to help you unlock the knowledge you need to take control of your money. Using our Retirement Road Map, we will show you strategies to create tax efficiencies in your retirement. To see what your personalized Retirement Road Map looks like, call our office at 775.853.9033.